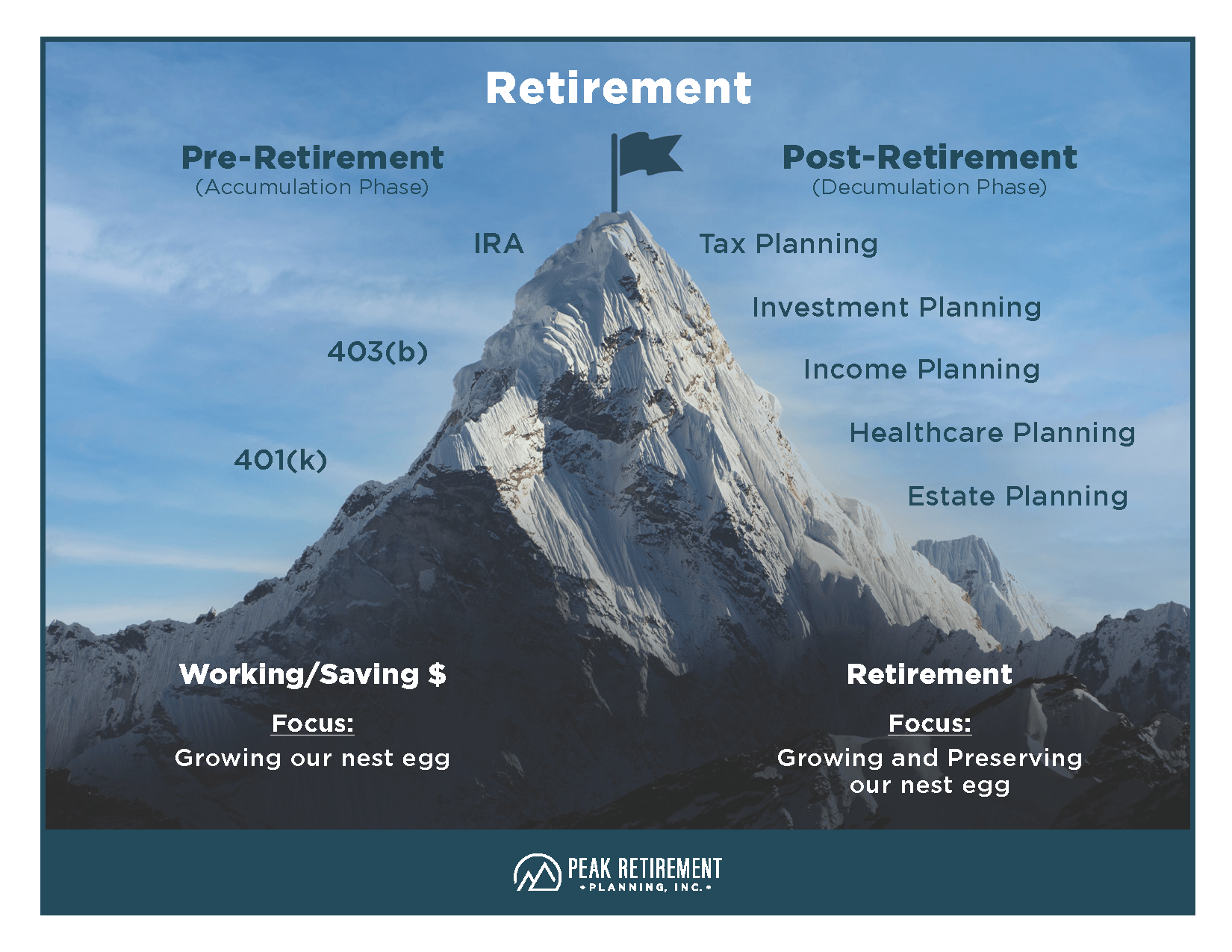

The Retirement Mountain

Reaching the summit is only the midway point of your journey.

At Peak Retirement Planning, we specialize in helping you get down the mountain to live the retirement you dream of. Here’s a helpful way to think about this process:

Our 5 Pillar Approach

Too often, we see people only getting 1 out of the 5 pillars (investment management) and ignoring the other 4 (which, in our opinion, are just as important, if not more) at this phase in your life. Our 5 Pillar approach is designed to reduce mistakes and allow you to live the retirement you deserve. We always say retirement is different than all of your working years. Our 5 Pillar Approach is designed to make this transition and have a comprehensive retirement plan.

Tax

Planning

- Use of tax software, reports and calculators

- Reduce lifetime taxes

- Tax return review

- RMD planning

- Roth conversions

- Charitable planning

Investment Planning

- Seeking protection and growth on your hard-earned life savings

- Eliminating unnecessary fees

- Professional investment management

Income

Planning

- Plan to get a paycheck for life to reduce the concern of running out of money

- Social Security planning

- Planning for inflation

Health Care

Planning

- Medicare planning

- Long-term care strategies

- Planning for out-of-pocket health care expenses

Estate

Planning

- Estate planning documents — trust, will, POA, etc.

- Survivor planning

- Reducing taxes to beneficiaries